In recent years, there has been increasing focus from investors, regulators, and the public on environmental, social, and governance (ESG) factors when evaluating companies. The European Union has been at the forefront of driving ESG disclosure regulations, particularly for financial institutions.

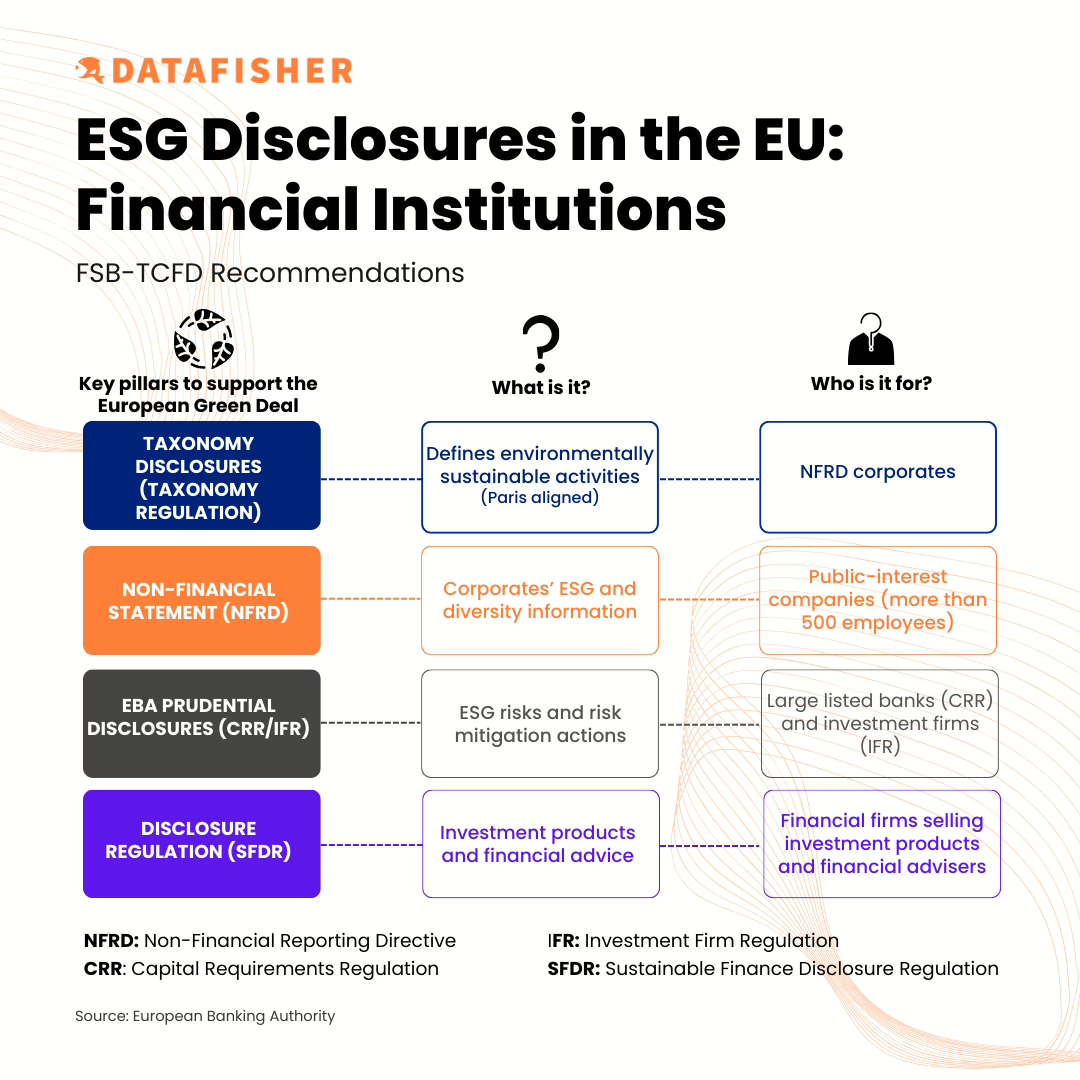

Under the EU Sustainable Finance Disclosure Regulation (SFDR), which began applying in March 2021, financial market participants like investment firms, banks, and insurance companies are required to disclose how they integrate sustainability risks into their investment decisions and advisory processes. Fund managers must also provide extensive ESG disclosures on their investment products.

The goal of the SFDR is to increase transparency around sustainability practices and prevent greenwashing. Financial institutions must disclose:

- Policies on integrating sustainability risks into investment decision-making

- Statements on due diligence policies for adverse sustainability impacts

- How their remuneration policies are consistent with sustainability risk integration

- Data on how they consider principal adverse impacts of investments

In addition, pre-contractual disclosures are required for investment products, including details on how the product considers sustainability factors and the product’s sustainable investment objectives, if applicable.

Financial institutions need help in gathering all the required ESG data from portfolio companies and funds to meet the SFDR disclosure requirements. There are concerns about consistency and reliability across the large volume of ESG data points now required. The SFDR requirements are just the beginning, as the EU is also rolling out the Corporate Sustainability Reporting Directive (CSRD) which will mandate extensive sustainability reporting covering ESG issues for large companies and financial institutions starting in 2025.

With the proliferation of ESG disclosure rules in the EU, financial institutions are rapidly building out their capabilities to collect, analyze, and disclose ESG information to comply with regulations and meet rising demand from investors. Those who fail to manage and disclose their ESG performance adequately may face scrutiny from regulators, investors, and the market.

As the EU’s expansive ESG reporting mandates take effect, Datafisher is well-positioned to create custom training programs to help companies in these industries navigate the new regulations.